Countries with High Income Tax Rates

Countries with High Income Tax Rates

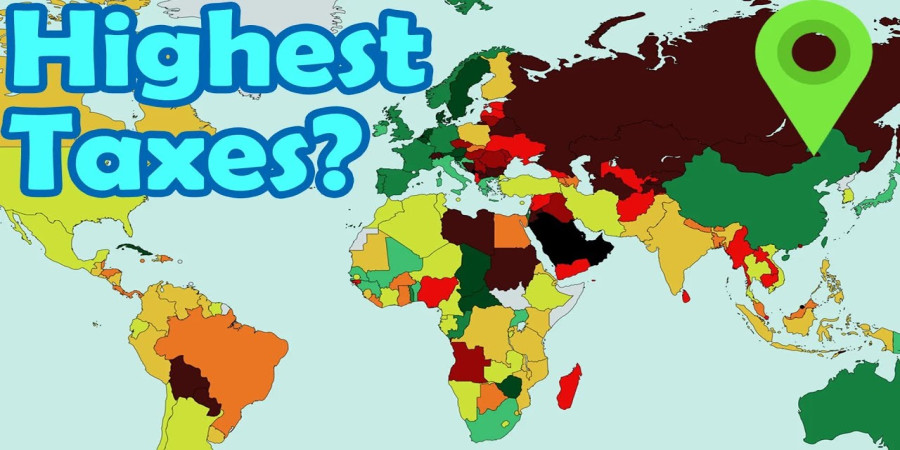

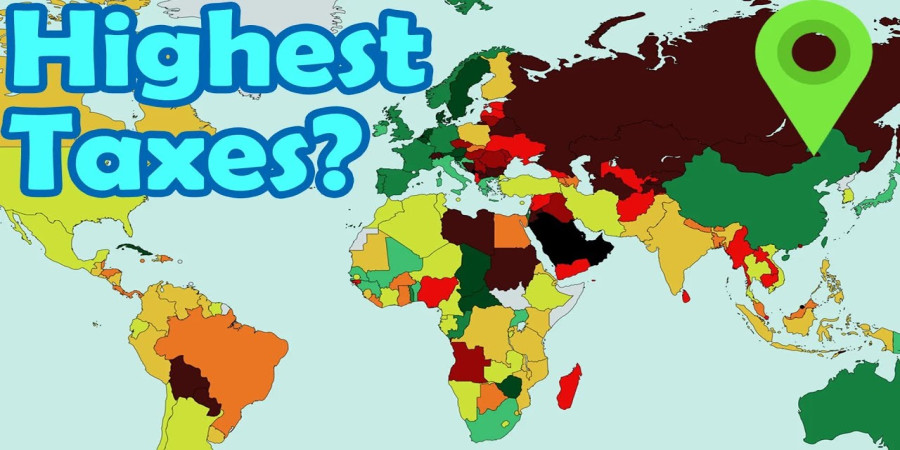

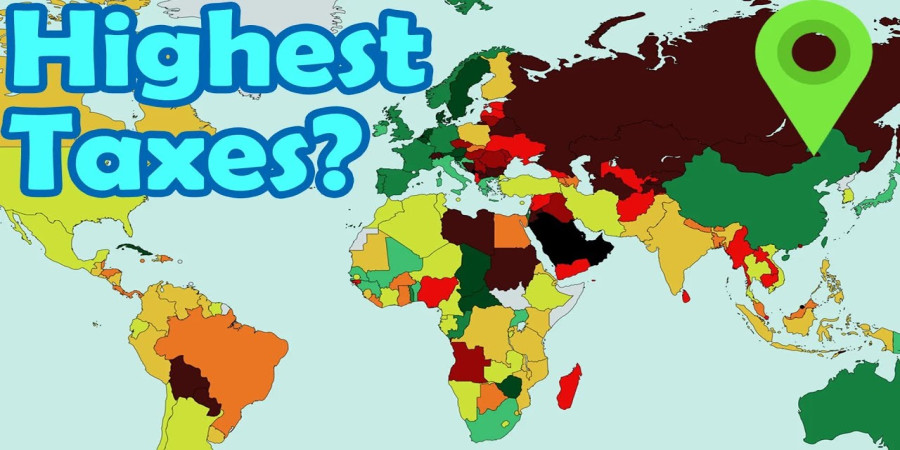

If you were planning to move to a new country, it is a good idea to see the income taxes of this place before going. Being single or married also matters when thinking about a potential new home. The countries with the highest taxes on high incomes, which are Slovenia, Belgium, Sweden, Finland, and Portugal, are different from the ones with the highest taxes on average income earners.

If you have children and a spouse, the situation changes again. Denmark is the country with the highest taxes for single and married individuals, but the other 4 European countries in this list are very different.

There are many countries in the world with different income tax rates. Here are a few examples:

-

Sweden: The income tax rate in Sweden ranges from 32% to 57%, depending on your income level.

-

Denmark: The income tax rate in Denmark ranges from 37% to 55.8%, depending on your income level.

-

Netherlands: The income tax rate in the Netherlands ranges from 9.45% to 49.5%, depending on your income level.

-

Finland: The income tax rate in Finland ranges from 6.5% to 31.75%, depending on your income level.

-

Belgium: The income tax rate in Belgium ranges from 25% to 50%, depending on your income level.

-

Austria: The income tax rate in Austria ranges from 0% to 55%, depending on your income level.

-

France: The income tax rate in France ranges from 0% to 45%, depending on your income level.

-

Iceland: The income tax rate in Iceland ranges from 35.41% to 46.24%, depending on your income level.

-

Norway: The income tax rate in Norway ranges from 0% to 22%, with most residents paying between 0% and 16.2%.

-

Portugal: The income tax rate in Portugal ranges from 14.5% to 48%, depending on your income level.

-

Germany: The income tax rate in Germany ranges from 14% to 42%, depending on your income level.

-

Switzerland: The income tax rate in Switzerland varies by canton (region), but can range from 0% to over 40%.

-

Italy: The income tax rate in Italy ranges from 23% to 43%, depending on your income level.

-

United Kingdom: The income tax rate in the UK ranges from 20% to 45%, depending on your income level.

-

Canada: The income tax rate in Canada ranges from 15% to 33%, depending on your income level.

-

Australia: The income tax rate in Australia ranges from 0% to 45%, depending on your income level.

-

Japan: The income tax rate in Japan ranges from 5% to 45%, depending on your income level.

-

Luxembourg: The income tax rate in Luxembourg ranges from 0% to 43.6%, depending on your income level.

-

Ireland: The income tax rate in Ireland ranges from 20% to 52%, depending on your income level.

-

South Korea: The income tax rate in South Korea ranges from 6% to 42%, depending on your income level.

It's important to note that tax rates can vary depending on factors such as marital status, number of dependents, and deductions. Additionally, some countries may have additional taxes, such as social security or health insurance taxes.

Popular articles

Apr 29, 2023 12:25 PM

Apr 29, 2023 12:31 PM

Apr 29, 2023 12:43 PM

Mar 26, 2023 02:34 AM

Apr 29, 2023 12:11 PM

Categories

Comments (0)